Fortifying an enterprise internally and externally

Board members of old days were more concerned about making profits than maintaining a stable flow of income for the organization and the investors. In times of crises, that may have risen from internal or external factors, the company’s profits and reputation plummeted, thus rendering all those profit-making schemes futile. A prime example of a company that poorly managed crises in India would be the Amitabh Bachchan Corporation Limited (ABCL). Established in 1995, this company ran afoul of its creditors and guarantors and had to resort to help from third party organizations such as the Board of Industrial and Financial Reconstruction (BIFR) when a consortium of lenders, headed by Canara Bank, pressed the corporation to pay up the monies due to them plus makeup for the arrears created by defaulted interest payments. Ironically, the then CEO of ABCL later on occupied a similar position in Coca-Cola, so one has to wonder just how much can a CEO handle in a company?

So what caused this company, which started with a bang, to slide into ignominy and bankruptcy? Internal and external risk factors that were improperly tackled were mainly the causes. Internal risk factors could be related to the technology and processed used to carry out the work, human resource related risks and physical damages such as damage to good in transit. External factors can be natural, political, economic or social in nature. So what approach should organizations take towards risks? They could use a 3-pronged strategy-

Prepare for the risks

Deal with the risks

Think out of the box

I PREPARING FOR THE RISKS

Take for example the Tata Nano controversy in Singur, West Bengal. The company had several options to build a car manufacturing unit in any part of India, but chose the Singur land which, as we all know, proved disastrous for the company. After futile struggles which lasted 28 months, Tata then shifted its unit to Gujarat and completed the project within 14 months. The company, though fully expecting to build a plant in WB, was prepared for the risk of not being able to and quickly thought of a plan B, which worked out quite well for them.

In surveys conducted from time to time, many organizations are asked how well-prepared they think they are to tackle any form of risk. More than 60% report they have an efficient enterprise risk management (ERM) team in place, but less than 19% actually are effective! This is because the risks jotted down on paper are different from the ones that plague companies in real life. So what are the best ways to prepare for risks?

Consider all internal and external factors thoroughly on a periodic basis.

Apply dynamic risk control strategies that are adaptable based on the crisis and the time it occurs.

Keep the risk management process as a mandatory part of running the organization. It should exist in perpetuity and not be created specifically in times of crises.

Gather accurate information from reliable sources such as studies, surveys, group discussions and contemporaries’ study. Sources of course can be internal and external in nature and it is vital to take the data from every source into consideration.

Explicit and implicit risks are to be considered while gearing up to face them.

II DEAL WITH THE RISKS

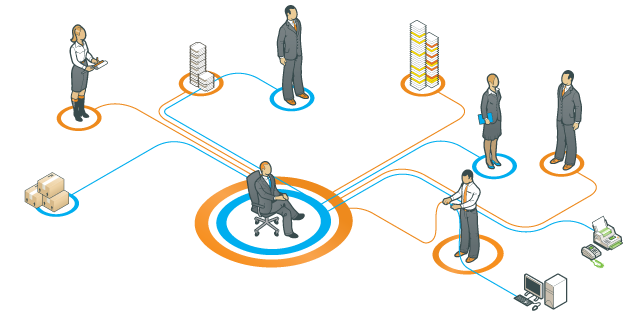

An efficient ERM team functions in tandem along with the management and HR team of an organization. An ERM team that is not synced with these teams cannot perform properly. Any segment of risk management will need input from employees of every level of the organization, so the human capital, its management and responding to its feedback are of vital importance to the ERM. After having assessed how the risks may arise, there are 4 keys areas that the ERM must work on in times of crises:

Work on the business strategy: Business organization’s success depends on the work ethics it cultivates amongst its employees and with outsiders. Such ethics and business strategies are highly susceptible to negative vibes from any crisis that hits the organization. The ERM must focus on keeping the profitable strategies alive while improving on the ones that need to be upgraded or eliminate those strategies, which are obsolete or drag the company into deeper crises. Creation of interim management jobs in India is on the rise with experienced people being hired to bridge the gap between the expected results and the ones that are actually achieved.

Handle the operations: While business strategies are being worked upon, the ERM team must focus on keeping the business activities functioning properly during the bad times. Lockouts and strikes are not helpful to either party, the employees or the organizations. Take for example the on-going lockout situation in Toyota Kirloskar Motor Pvt. Ltd. in Bidadi. The workers are refusing to resume work because they want a better pay hike and refuse to sign an undertaking of “good conduct” with the company. The State Labor Minister intervened and work did take place for a weekend, but the unit is back to its lockout ways, for the present. During these times, succinct and transparent communication to all members of the organization is an internal measure to be followed while effective communication with outsiders such as the media, stakeholders and creditors ensures the company’s image does not hit rock-bottom. Brainstorming sessions, providing incentives and perks to employees, rewarding the innovative thinkers, these are some of the ways in which operations can be improved upon during difficult times.

Manage the finances: From an outsider’s point of view, this really is a crucial factor in deciding how effective an ERM team is. Does the team save the company’s fortunes or cost it one? Are the stakeholders and creditors able to sleep easy at night, assured that their money is in safe hands? Is the company’s profit graph full of highs or lows? How quickly can the company get out of its slump? Are the employees getting their salaries on time? Is the debt to income ratio still stable? These are just some of the areas, which the ERM group focuses on. The idea is to plug holes in the company’s finances to retain what profits it has already earned and letting very little slip out.

Compliance Factors: Legal battles are time-consuming but necessary. An ERM team must ensure the organization stays within the legal boundaries associated with it at all times. Internal and external auditing is a good idea at this time. Auditors don’t just highlight when 2 and 2 don’t add up to 4. They also show why there are discrepancies and how they should be avoided. And the ERM team, taking into consideration the auditor’s report and after conducting its own research, comes up with feasible recovery plans for the organization that are legal and do not break any agreements that are entered into with partner firms and creditors.

👋 contact us

👋 contact us